Money may drive the world, but moving it efficiently has always been a challenge.

For a long time, businesses have relied on rigid, bulky systems. To make sure that things are running smoothly, companies may require expensive banking partnerships, long hours of integration, and a whole compliance department.

The arrival of payment as a service platform (PaaS) here is like a quiet revolution, which has changed the ways in which companies manage payments.

Whether it is sending, receiving, or verifying — everything is taken care of.

What Traditional Payment Setups Looked Like

Back in the day, payouts were more of a headache. Most businesses handled everything manually, and the process went something like this –

- Someone had to download all the invoices and go through them one by one.

- The data was then exported into spreadsheets, which were then uploaded into a banking portal.

- When it comes to compliance checks, even KYCs and tax validations were done manually.

- If a payment failed, as it often did, that too had to be tracked down and fixed individually.

- Every payout had to be logged and accounted for in audits.

- If any issues arose, you would end up calling the bank to check for the reasons, which would then finally lead to a resolution.

This whole process was chaotic and cumbersome for businesses. Eventually, as the market transitioned, more affiliates, vendors, and partners were added to the system, which meant more payout work. Managing the load from the increased number of payouts became even more difficult.

PwC has elaborated on the current ecosystem, noting that it has become challenging. This is because it is hard to keep the cost of ownership low when licensing, compliance, technology, and programme management are all to be paid for.

PaaS enters here as a solution.

It resolves all these pains by combining the manual steps and turning them into automated and streamlined operations.

What is a Payment as a Service Platform?

Payment as a service platform, as a model, is like using ready-made building blocks. It is a specialised platform that is meant to handle all your payout operations, from onboarding to compliance to settlement.

Here, instead of building your own payment systems and infrastructure from scratch, you outsource your payment-related technology and operations to a third-party platform.

PaaS means all the payment-heavy lifting tasks are being done for you.

Instead of doing everything manually, this system provider does everything behind the scenes- be it card payments, bank transfers, wallets, security, fraud checks, KYC, compliance, or settlement. It is like your very own payment toolbox to pick only those tools that you actually need.

What is the Need for This Service?

Building and running a full payment system requires investment of time, money, and manpower. By outsourcing through PaaS, operators avoid heavy initial burdens as they don’t have to have their own servers or big tech teams.

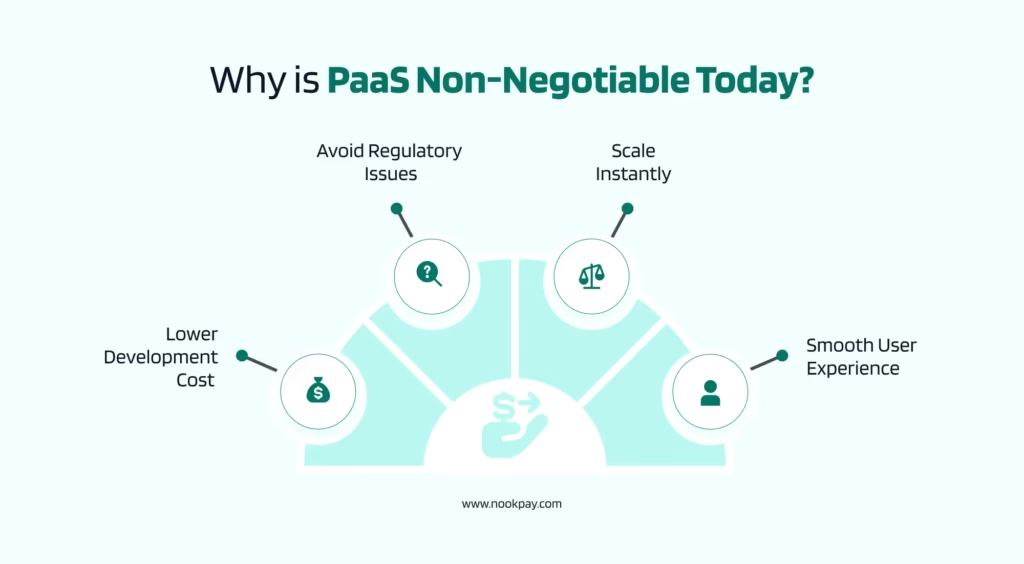

This means, with its help, you can –

- Go-live faster

- Lower development costs

- Avoid regulatory issues

- Scale instantly

- Lead a smoother customer or vendor experience

In the world of financing, PaaS helps you switch from cooking every meal from scratch to having a smart kitchen that prepares everything for you.

All you have to do is choose and use.

The Core Building Blocks of Payment as a Service Platform

Modular Architecture: Use What You Need

A modern PaaS platform is made of several parts that can be put together in different ways, just like LEGO blocks.

A business can only pick parts that it needs, such as –

- Vendor onboarding

- KYC and compliance

- Payout engine

- Wallet system

- Invoice matching

- Reconciliation

- Reporting and audit trails

For example, a new online marketplace can start off with just a payout module, which ensures that vendors are paid automatically and accurately.

With time, as the platform grows, they can add other modules in accordance with their requirements. It can be a tax invoice verification, KYC compliance, or mass balancing, without having to build the system from scratch.

This also means minimal negotiations with new vendors every time a feature is added; PaaS simply rolls it out.

The Bridge of APIs

An Application Programming Interface is one of the fundamental base elements of PaaS, as it enables seamless integrations and functionality.

It acts as a bridge between your system and the payment as a service platform.

Here is how API does its work –

- As a seller completes an order, the API triggers their payout

- An affiliate reaches his minimum threshold, the API generates and pushes the invoice

- Your SaaS platform processes a refund, API handles the money movement automatically

This generates an interaction between your business and PaaS in a smooth way, which reduces the manual work to almost zero.

APIs integrate directly with your website, app, CRM, or marketplace dashboard.

With the help of these integrations, you can make payments, refunds, payouts, wallet transfers, or invoice flows without creating your own payment system.

The Role of Compliance

The burden of regulatory compliance gets reduced dramatically as PaaS comes into the picture. Payment processing is heavily regulated due to the requirements of KYC, AML, data security, etc, which is also considered to be a liability by many.

PwC highlights that here, with the help of outsourcing, your business does not have to store any data or think about the complex rules, as the payment services take on that role.

The service provider also takes the responsibility of risk management by tokenising card data, monitoring transactions, and even automating the screening of sanctions.

However, PwC also points out that these core compliance responsibilities must remain with the organisation as per the RBI rules.

Hence, it must be understood that a payment as a service platform can only simplify compliance; it cannot remove accountability.

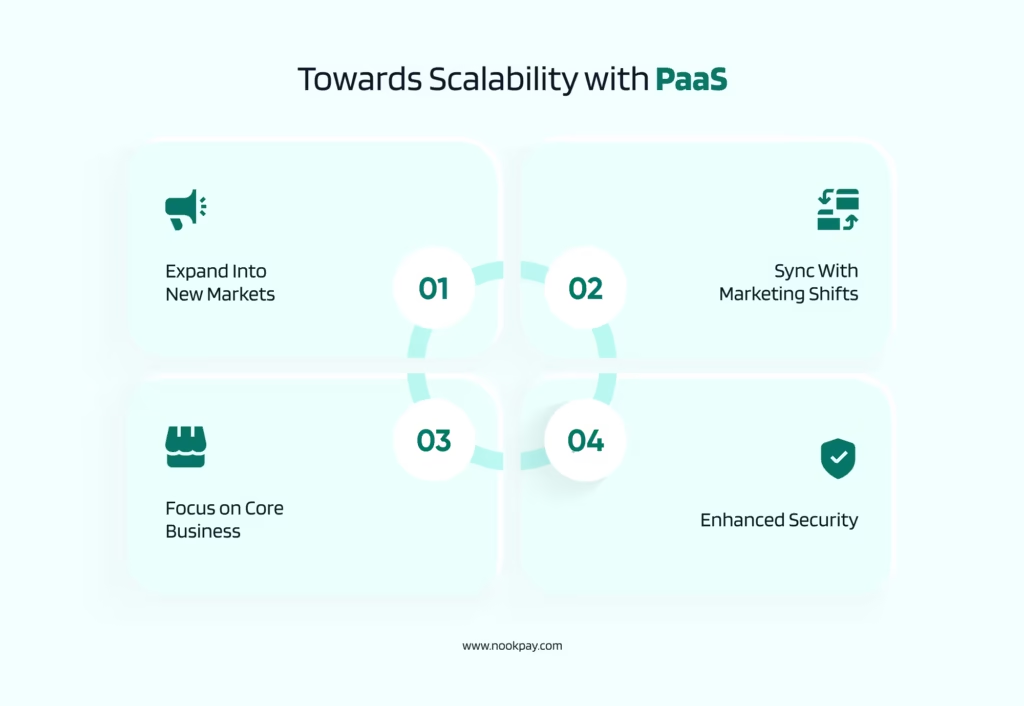

Towards Scalability With PaaS

As businesses expand, they have more customers, vendors, transactions, and payouts to manage. Keeping everything organised and smooth becomes a necessity here.

A spike in the business also means more servers, more manpower, and more compliance checks. Traditional systems don’t work here and don’t help much with scalability.

And this is exactly where a payment as a service platform quietly becomes a growth engine.

The following are how it can help your business scale –

- Expand into new markets: Rather than spending money and time on building local payment systems, businesses can leverage PaaS to start accepting payments instantly.

For example, a software company, with the help of the payment platform, conveniently launched its services in Japan within weeks. It helped them handle local compliance, integration with Japanese payment methods, and currency conversion. - Move forward with the market: Businesses do not have to contemplate launching new payment methods ( digital wallets) and features, which will also keep them in pace with market trends and competitors.

- Focus on core business: Outsourcing payment technology allows teams to concentrate on product development and customer service rather than backend management.

- Enhanced features and security: Access to advanced features like fraud detection, along with strong compliance and security features reduces risk and protects your business from suspicious activities. Additionally, with the advent of AI fraud detection, chargeback rates have been reduced by 30% on average.

A payment as a service platform, hence, provides a payment infrastructure that allows businesses to grow their transaction volume and offerings without their payment systems breaking.

Who Can Use PaaS?

Now that we have developed an understanding of what PaaS is and how it makes operations better, the next question that arises is: Which businesses can rely on it?

Multiple industries can use this technology for different purposes as per their requirements. However, some of the major sectors that can leverage the technology are –

Fintech Startups

Fintech companies are one of the biggest and earliest adopters. Fintech startups don’t often have deep pockets or the time required to build payment infrastructure from scratch. Payment services give them a ready-made and affordable way to offer services like UPI, wallets, card transfers, cross-border payouts, without getting entangled in licensing, compliance, or legacy banking systems.

Marketplaces and Aggregators

Marketplaces, be it of goods, services, or freelance work, often deal with a large number of vendors and all of them have different payout schedules. Payment as a service platform helps them by –

- Automating vendor onboarding

- Managing tax-invoice validation

- Matching invoices with purchase orders

- Triggering payouts automatically or as per defined rules

Platforms like Nookpay serve this very purpose as they offer automation and global payout features, which make the system scalable and flexible.

SaaS Companies with Payment or Billing Features

Many SaaS companies like Trackier offer billing, invoicing, or multi-currency payments. PaaS lets them integrate payment and billing features without building them in-house. Whether they’re collecting monthly subscriptions or issuing refunds worldwide, they get a consistent, compliant payment infrastructure with the help of APIs, with built-in reconciliation and reporting.

This lets them focus on their core product rather than payment operations.

High-Volume Enterprises

Large enterprises have complex payout needs as they could be working with suppliers, distributors, freelance workers, or retail partners. They can benefit from PaaS as it helps them –

- Automate vendor payouts

- Handle bulk settlements

- Manage compliance checks

- Scale operations

It is especially beneficial for firms that operate across multiple countries as it helps them make settlements across borders, multi-currency payouts, and a unified vendor management.

Final Thoughts

As everything is becoming digital, businesses require systems that are fast, reliable, compliant, and able to scale without friction. This applies to payout systems as well.

A payment as a service platform does exactly that as it lowers the necessity to reinvent everything with the help of manual operations.

Platforms like Nookpay act like a modern payment backbone that helps businesses grow. It allows you to focus on what truly matters, that is, building better products and services. When it comes to payments? Nookpay will take care of it all behind the scenes!

Help Centre

What is a payment as a service platform, and how is it different from a payment gateway?

A payment as a service platform goes beyond simple payment collection. Unlike gateways that only process transactions, a payment-as-a-service manages payouts, onboarding, compliance, reconciliation, and reporting—acting as a full financial operations layer rather than just a checkout or transfer tool.

How does a payment as a service platform support businesses with complex payout relationships?

For businesses managing affiliates, vendors, partners, or contractors, a payment as a service platform centralises payouts under rule-based automation. It ensures accurate settlements, transparent records, and predictable payment cycles, helping relationship-driven businesses maintain trust while handling large, recurring, or multi-party payment flows.

Is a payment as a service platform suitable for independent professionals and small teams?

Yes. A payment as a service platform removes the need for technical expertise or banking coordination. Independent professionals and small teams can manage invoicing, compliance checks, and payouts efficiently without building internal systems, allowing them to operate at scale without increasing operational complexity.

How does a payment as a service platform reduce operational risk in global transactions?

A payment as a service platform standardises processes across regions by handling currency conversions, compliance checks, and transaction monitoring centrally. This reduces human error, minimises failed payments, and provides clear audit trails, which is especially valuable for globally connected businesses managing cross-border financial relationships.