Imagine the month is about to end, and you are continuously getting notifications about pending invoice approval requests; now you have to recheck and approve them manually.

Frustrating right?

You are not alone. In today’s time, there are many businesses that are still struggling with spreadsheets, emails, and outdated manual approval flows.

And when companies grow, these manual systems become an obstacle that disrupts the operations.

To maintain proper flow in operation, modern businesses are choosing automated payable solutions to maintain proper cash flow and seamless approval processes. No bug, no delayed payment.

In this blog, you will learn about Automated Payables Solutions — how they work, their key features, and how payout automation platforms like Nookpay help businesses simplify and scale their payables operations.

What are Automated Payables Solutions?

AP solutions is a system that is designed to manage the entire accounts payable lifecycle without any manual process. These solutions have replaced paper-based and spreadsheet-driven manual workflow with an automated process that handles timely approvals, error-free invoicing, and fast payout.

Instead of finance teams manually entering data, routing invoices, and triggering payments, automation takes over repetitive tasks. This reduces manual errors, improves turnaround time, and ensures payments happen on schedule.

At their core, these solutions help businesses achieve:

- Faster processing times

- Reduced operational costs

- Enhanced compliance and audit readiness

- Improved vendor relationships

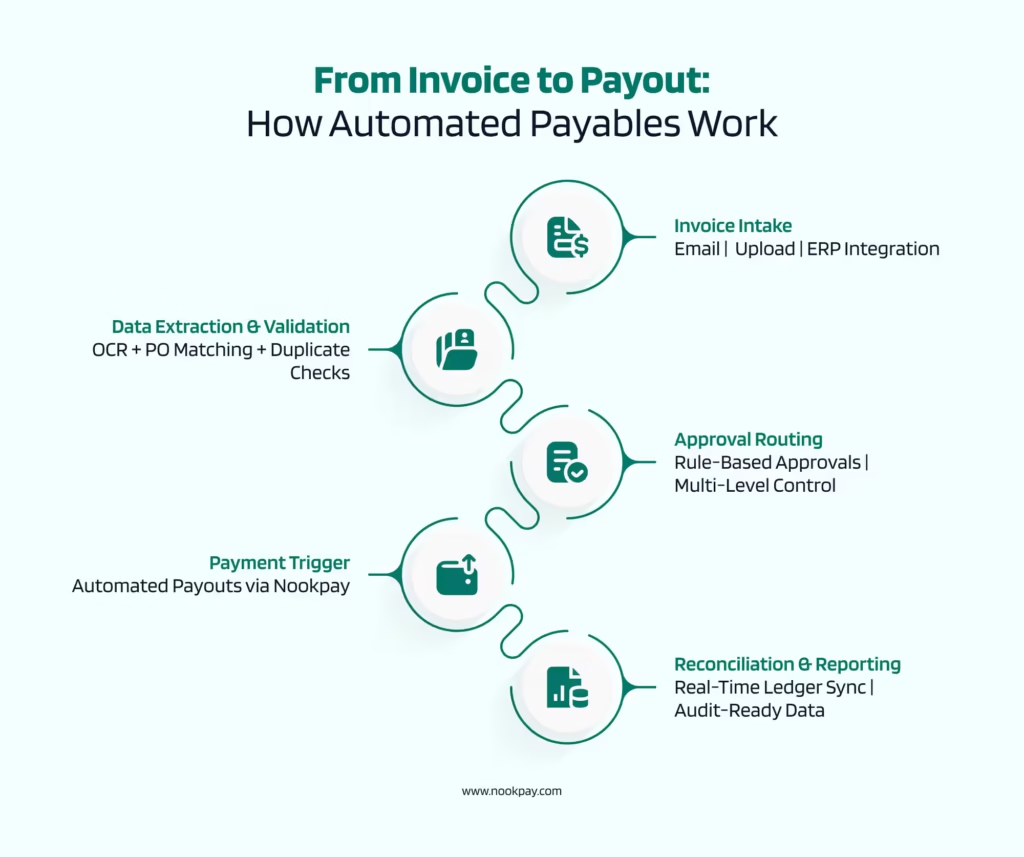

How Automated Payables Solutions Work: Step-by-Step

Understanding how payables solutions function helps businesses clearly see where automation creates real value. Instead of handling each task manually, automation connects every step of the payables process into one smooth, controlled flow.

Let’s break it down step by step.

Step 1: Invoice Intake

The process begins when invoices are received digitally. Instead of paper invoices or scattered emails, automated payables solutions centralize invoice intake.

Invoices can come from:

- Email inboxes

- Vendor portals

- Direct ERP or accounting system integrations

Once received, invoices are automatically captured and stored in a single system. This removes the risk of misplaced invoices and gives finance teams full visibility from day one.

Step 2: Data Extraction and Validation

Once the invoice is received, the system automatically reads and captures important details like invoice number, amount, and due date.

It also checks the invoice against purchase orders and vendor records. This helps catch mistakes, duplicate invoices, or incorrect amounts early.

This step significantly reduces errors and prevents overpayments or fraud before invoices move forward.

Step 3: Approval Routing

Once validation is done, invoices are automatically routed for approval based on predefined business rules.

For example:

- Low-value invoices may auto-approve

- High-value invoices may require multiple approvals

- Department-specific invoices go to relevant managers

Rule-based approval workflows remove delays caused by manual follow-ups and ensure accountability at every stage.

Step 4: Payment Trigger

After approvals are completed, payments are automatically triggered without manual intervention.

This is where payout automation platforms like Nookpay play a critical role. Payments are executed based on:

- Due dates

- Approval completion

- Predefined payout schedules

By automating payouts, businesses ensure timely vendor payments, reduce operational workload, and maintain strong vendor relationships.

Step 5: Reconciliation and Reporting

Once payments are completed, transaction records automatically sync with accounting and ERP systems.

This enables:

- Real-time reconciliation

- Accurate financial reporting

- Easy audit preparation

Finance teams no longer need to manually update records or chase payment confirmations. Everything stays aligned and up to date.

Why This Workflow Matters

This end-to-end flow is the backbone of modern Automated Payables Solutions. By connecting invoice intake, approvals, payouts, and reporting into one automated system, businesses gain speed, accuracy, and complete financial control.

Key Features of Automated Payables Solutions

Payables solutions offer a set of powerful features that help businesses to manage payables more efficiently, accurately, and at scale. These features focus on control, visibility, and automation rather than manual effort.

1. Centralized Payables Management

Automated payables solutions bring all payables activities into one unified platform. Instead of managing invoices through emails, spreadsheets, and banking portals, finance teams can access everything in one dashboard.

This centralization improves visibility, reduces miscommunication, and makes it easier to track invoice status, pending approvals, and completed payments. It also helps teams stay organized as transaction volumes increase.

2. Smart Approval Controls

Approval processes are fully customizable. Businesses can define who approves invoices based on amount, department, or vendor type. For example, high-value invoices may require multiple approvals, while low-value invoices can be approved quickly.

This feature ensures strong financial control without slowing down operations. It also creates accountability, as every approval is logged and traceable.

3. Automated Payment Execution

Once an invoice is approved, the system automatically handles payment execution. There is no need for finance teams to manually initiate bank transfers or schedule payments.

Automated payment execution reduces delays, ensures timely payments, and helps maintain healthy vendor relationships. It also eliminates common human errors such as incorrect amounts or missed deadlines.

4. Built-In Payout Automation

Payout automation extends automation beyond approvals into actual fund disbursement. With solutions like Nookpay, businesses can automate payouts to vendors, partners, affiliates, or contractors.

Payments are triggered based on predefined rules or schedules, making it easy to manage high-volume payouts efficiently. This feature is especially useful for businesses operating at scale or handling frequent recurring payments.

5. Error and Risk Reduction

Automated payables solutions include built-in checks that help detect duplicate invoices, mismatched amounts, or incorrect vendor details before payments are made.

By identifying issues early, businesses reduce the risk of overpayments, fraud, and compliance problems. These safeguards create a more secure and reliable payables process.

6. Real-Time Visibility and Tracking

Finance teams gain real-time visibility into every stage of the payables process. Dashboards show which invoices are pending, approved, or paid, along with payment timelines.

This visibility supports better cash flow planning, faster issue resolution, and informed financial decision-making.

7. Seamless Integration with Existing Systems

Automated payables solutions integrate smoothly with ERP systems, accounting software, and banking infrastructure. This ensures consistent data flow without manual re-entry.

Integration reduces reconciliation efforts and keeps financial records accurate and up to date across systems.

8. Audit-Ready Records and Compliance Support

Every activity in the payables process is recorded automatically. This creates a complete audit trail that includes invoice history, approval records, and payment details.

These records simplify audits, support regulatory compliance, and reduce the time and effort required during financial reviews.

Why Businesses Are Moving to Automated Payables Solutions

Manual payables may work at a small scale, but they struggle with growth. As transaction volume increases, finance teams face common challenges such as delayed approvals, lack of visibility, and payment failures.

Automated Payables Solutions solves these problems by creating structured, rule-based systems that scale with the business.

Key reasons businesses adopt automation include:

- Faster invoice approvals

- Reduced dependency on emails and spreadsheets

- Better control over payment schedules

- Improved audit and compliance readiness

- Real-time reporting and insights

For fast-growing companies, automation is no longer a “nice to have.” It is a foundation for financial stability.

Real-World Use Cases of Automated Payables Solutions

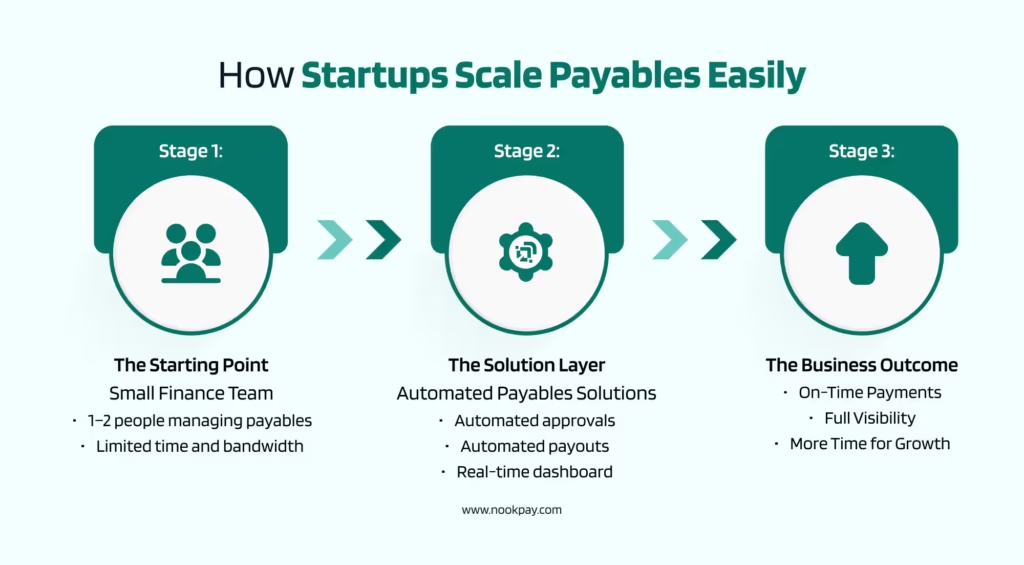

Use Case: Growing Startups

As startups scale, invoices and payments increase quickly, but finance teams remain small. Managing payables manually becomes difficult and time-consuming.

Automated Payables Solutions help startups handle higher transaction volumes without hiring more staff. Invoices, approvals, and payments are automated, giving founders and finance teams clear visibility while they focus on growth.

Final Thoughts

Manual payables slow businesses down. Automation speeds them up.

By adopting Automated Payables Solutions, businesses eliminate inefficiencies, reduce errors, and gain complete control over their financial operations. When combined with payout automation platforms like Nookpay, automation extends beyond approvals to actual payment execution.

For finance teams aiming to scale confidently, automated payables are not just an upgrade — they are a necessity.

1. What are automated payables solutions, and why do businesses use them?

Automated payables solutions help businesses manage invoices, approvals, and payments without manual effort. Companies use automated payables solutions to reduce errors, speed up approvals, improve cash flow visibility, and ensure on-time payments as transaction volumes grow.

2. How do automated payables solutions improve cash flow management?

Automated payables solutions provide real-time visibility into pending invoices, approved payments, and upcoming payouts. This helps finance teams plan cash flow better, avoid last-minute payment pressure, and maintain a healthy balance between outgoing payments and available funds.

3. Are automated payables solutions suitable for small and growing businesses?

Yes, automated payables solutions are especially useful for startups and growing businesses. They allow companies to handle increasing invoice volumes without expanding finance teams, helping businesses scale operations efficiently while keeping costs under control.

4. How do automated payables solutions reduce errors and payment risks?

Automated payables solutions automatically validate invoice data, detect duplicates, and match invoices with purchase orders or vendor records. These built-in checks reduce manual mistakes, prevent overpayments, and lower the risk of fraud or compliance issues.

5. Can automated payables solutions integrate with payout automation platforms like Nookpay?

Yes, automated payables solutions can integrate with payout automation platforms like Nookpay to automate actual payment execution. This ensures approved invoices are paid on time, payouts follow predefined rules, and financial records stay updated without manual intervention.