Imagine signing up for a subscription you love. Everything works fine, but one month, your payment fails, or you don’t get a renewal reminder. Suddenly, your access is blocked—not because of the product, but because of billing issues.

In today’s world, subscriptions are everywhere, and a smooth billing process is the key to keeping customers happy.

Apps, streaming services, gyms, and online games all rely on regular, predictable payments to grow.

This is where a digital billing and payment platform comes in. It doesn’t just take payments—it can automatically handle renewals, track usage, fix failed payments, and help keep customers from leaving.

In this article, we’ll explain how these platforms help subscription businesses run smoothly and grow.

What is a Digital Billing and Payment Platform?

A digital billing and payment platform is a system that helps businesses to charge customers, collect payments, and manage their subscriptions automatically without any delay.

Instead of manually sending invoices or tracking payments, the platform does it all:

- Collect payments

- Generate invoices

- Manage subscriptions

- Track billing schedules

Advanced platforms also handle:

- Recurring billing

- Usage-based or metered pricing

- Failed payment recovery (dunning)

- Churn reduction tools

For subscription businesses, a billing platform is more than finance software—it’s the backbone of revenue.

Why Subscription Models Need Specialized Billing?

Subscriptions aren’t like one-time purchases. They involve ongoing relationships with customers, which bring challenges like:

1. Recurring Payments

A digital billing and payment platform automates recurring charges so customers are billed on schedule without manual intervention. This reduces missed payments and ensures predictable revenue.

2. Plan Changes and Flexibility

Customers often upgrade, downgrade, or pause their subscriptions. Specialized billing platforms manage these changes automatically, ensuring that invoices reflect the correct amount and the customer experience remains smooth.

3. Failed Payment Recovery

Payment failures happen due to expired cards, insufficient funds, or outdated payment details. A digital billing and payment platform includes dunning management, retries failed payments, and sends reminders to reduce involuntary churn.

4. Usage-Based or Metered Billing

Many subscription services, like SaaS or utilities, charge based on usage. Specialized billing platforms track usage and calculate charges accurately, which is difficult to manage manually or with a simple payment gateway.

5. Compliance and Tax Management

Subscriptions may involve customers in multiple regions. A digital billing and payment platform automatically handles taxes, currency conversions, and compliance, reducing errors and administrative work.

A regular payment gateway can’t handle these complexities. A digital billing and payment platform ensures businesses get paid on time, every time, while keeping customers happy.

How Digital Billing Platforms Automate Recurring Billing

Recurring billing is the core of any subscription business. A digital billing and payment platform automates this process so businesses can collect payments on time without manual effort.

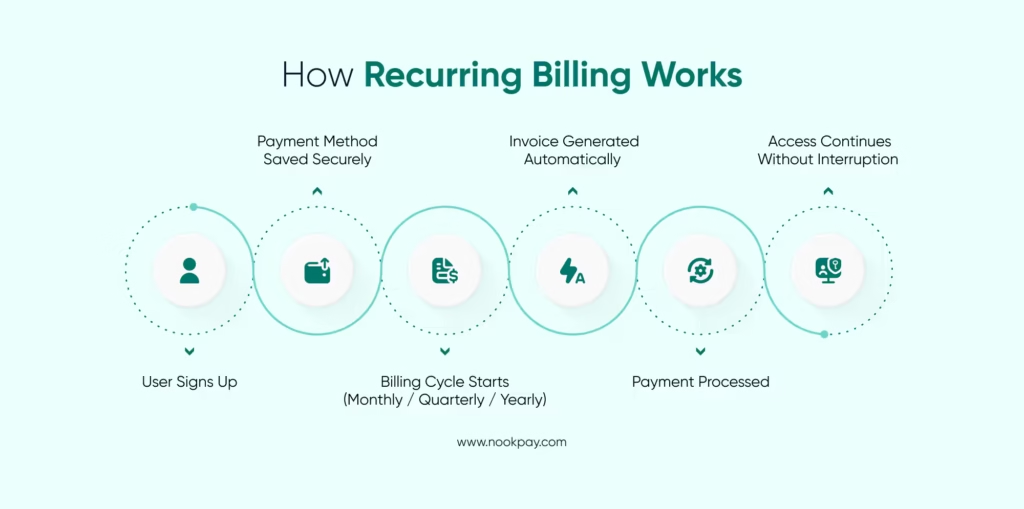

Here’s how it works in simple terms:

First, when a customer signs up for a subscription, their payment details are securely saved in the system. The platform also records the billing plan, such as monthly, quarterly, or yearly.

Next, the platform automatically triggers billing based on the chosen cycle. On the scheduled date, it generates an invoice and processes the payment without needing any manual action from the business team.

The platform also handles important billing details automatically, including:

- Applying taxes based on location

- Adding discounts or promo codes

- Updating charges when a customer upgrades or downgrades a plan

If a payment is successful, the subscription continues without interruption. If a payment fails, the platform starts retry attempts and notifies the customer to update their payment details.

By automating recurring billing, digital billing platforms help businesses:

- Avoid missed or late payments

- Reduce billing errors

- Save time and operational costs

- Maintain steady and predictable recurring revenue

In short, a digital billing and payment platform ensures subscriptions renew smoothly, payments are collected on time, and customers enjoy uninterrupted service.

Title: How Recurring Billing Works

Concept: User signs up → Payment saved → Billing cycle → Invoice → Payment → Access continues

Why Digital Billing Platforms Are a Smart Investment

A digital billing and payment platform is more than a payment tool. It is a strategic investment that supports long-term growth, especially for subscription and recurring revenue businesses. Below is a clear breakdown using both paragraphs and bullet points.

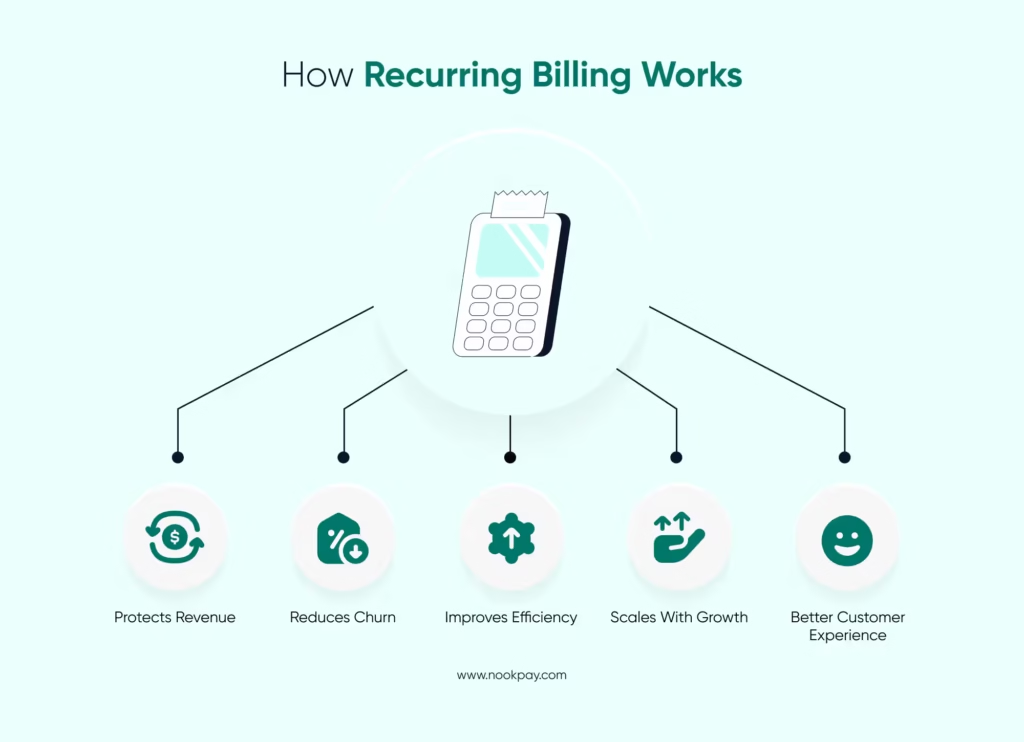

1. Protects Recurring Revenue

Recurring revenue depends on timely and accurate billing. Digital billing platforms automate the entire billing cycle, reducing the risk of missed or delayed payments. This ensures stable cash flow and better financial planning.

How it helps:

- Automates recurring charges and renewals

- Reduces billing errors and revenue leakage

- Ensures payments are collected on time

2. Reduces Customer Churn

Many customers churn due to payment failures, not because they are unhappy with the product. Digital billing platforms include built-in tools to recover failed payments and keep customers active.

Key churn-reduction features:

- Automated payment retries (dunning management)

- Email or SMS reminders for failed payments

- Easy payment method updates

3. Improves Operational Efficiency

Manual billing processes take time and resources. A digital billing and payment platform automates repetitive tasks, allowing teams to focus on growth and customer experience.

Operational benefits:

- Automatic invoice generation

- No manual follow-ups for renewals

- Faster billing and reporting workflows

4. Scales Easily as the Business Grows

As subscription numbers increase, billing becomes more complex. Digital billing platforms are built to scale without adding operational burden.

Scalability advantages:

- Handles high transaction volumes

- Supports multiple pricing and subscription models

- Works across regions and currencies

5. Enhances Customer Experience

A smooth billing experience builds trust and loyalty. Customers prefer clear, transparent, and flexible billing processes.

Customer experience improvements:

- Clear invoices and billing history

- Multiple payment options

- Easy plan upgrades or downgrades

Final Thoughts

The subscription economy is growing fast, and smooth billing has become a key factor in success. Even small billing issues can lead to failed payments, customer frustration, and churn.

A digital billing and payment platform helps businesses automate recurring billing, manage renewals, reduce payment failures, and support flexible pricing models. It ensures steady revenue, better customer retention, and efficient operations as the business scales.

Simply put, strong subscription businesses rely on reliable billing systems. Investing in the right digital billing platform helps businesses grow with confidence and consistency.

Help Centre

1. What is a digital billing and payment platform?

A digital billing and payment platform is a system that automates billing, payment collection, and subscription management for businesses, reducing manual effort and errors.

2. How does a digital billing and payment platform support recurring revenue?

It automates recurring billing, handles renewals, and ensures payments are collected on time, creating a predictable cash flow.

3. Can a digital billing and payment platform recover failed payments?

Yes. Most digital billing and payment platforms include dunning management, automated retries, and customer reminders to minimize revenue loss.

4. Does it work for usage-based or metered subscriptions?

Yes. Digital billing platforms can track usage, calculate charges accurately, and bill customers accordingly.

5. How does it improve customer experience?

By providing clear invoices, multiple payment options, and easy plan upgrades or downgrades, it ensures smooth and transparent billing for customers.