Ever had affiliates message you nonstop about missing or incorrect payments? That’s your payout system asking for an upgrade.

What’s worse? This could be an issue faced by multiple affiliates that you are associated with, which can further impact the management of your affiliate program.

Keeping track of affiliate commissions, invoices, tax forms, payout schedules, and payment statuses manually is no longer as easy as it once was.

And this will not just affect your relations with the affiliates but will also cause financial losses and reputational damage to your business.

This is what happens when your payment system is manual. Affiliate payment automation defies it all.

Why Manual Payments Don’t Work Anymore

“Manual payments are fun,” said no one ever.

According to research by Forrestor, most businesses have more than 20 employees to manage payments. However, despite having a whole team manage payments, mistakes are unavoidable.

Excel sheets, emails, and manual bank uploads cannot keep up with the speed, volume, and complexity of the modern affiliate system. Especially when it comes to fast-paced industries like fintech, SaaS, or eCommerce, where thousands of conversions happen every day.

Hence, the reasons why manual payments don’t work anymore are that they can cause –

Problems With Spreadsheets and Unconnected Financial Tools

Most finance and affiliate teams still juggle through Excel sheets, CSV exports, direct messages, email threads, and separate tracking platforms. But there is no connection between them, which means –

- Multiple versions of the data

- Data inconsistencies across the teams

- High chance of approving incorrect commissions

When payouts depend on such tools, accuracy is replaced by odds and guesswork, as there is no guarantee.

Scaling to Thousands of Affiliates Becomes Unmanageable

When a business works with multiple affiliates, manually checking on all of them is unrealistic. This is because each affiliate could have –

- Different commission model

- Different brand or geo to work on

- Different currencies to work on

Calculating payouts manually at such varying scales is not only slow but also unsustainable.

Errors Become Inevitable

Manual calculations can also have human errors at multiple steps-

- Wrong formulas

- Overpayment or underpayment

- Missed validation

- Mismanaged exchange rates

All these inconsistencies eventually lead to delayed or failed payments. Even a small mistake can escalate into disputes, cause mistrust, and financial loss.

If the market is competitive, affiliates won’t wait for you to sort things out. It will not take them much time to switch to a brand that pays them correctly and on time.

Compliance Becomes More Complicated

As your business goes global, your affiliate programs will go global too. Compliance, hence, becomes a necessity, but also a challenge.

- Regional tax requirements

- Anti-money laundering (AML) rules

- Banking regulations

Hence, when it comes to going global, manual systems make it almost impossible to stay compliant without investing massive time and resources.

The consequences? Disputes, wasted operational time, and eventually the affiliate churns.

The solution? Switch to a payment automation platform

What is Affiliate Payment Automation?

It is a way to transition from chaos to order and management.

At its core, it is a technological system that tracks commissions, validates payouts, calculates earnings, and releases payments, all without any manual intervention.

Going beyond the definition, its value lies in the problems it solves: delays, human errors, and operational loads that grow as a business scales.

And so, instead of making you juggle through multiple tools and spreadsheets, automation provides a single flow where commissions are recorded in real time.

It does not just match the commission data against the rules that you set, but also automatically approves it and makes the payment with the help of integrated gateways.

No repetitive work.

No guesswork.

No “copy-paste” blunders that can cost you both money and trust.

For affiliates, this means getting paid consistently and on time.

For brands, it means organised workflows, fewer disputes, and more scope to focus on growth instead of admin work.

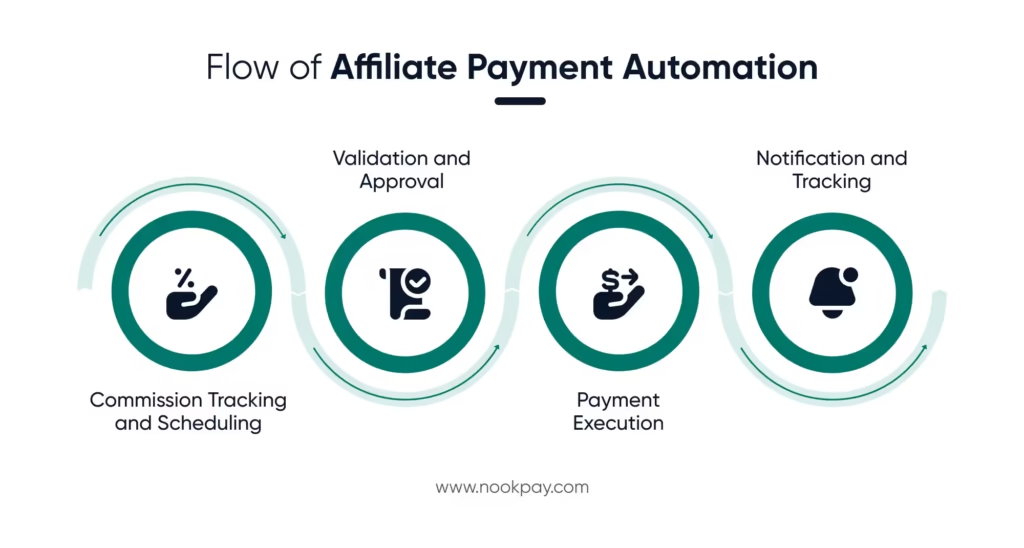

Flow of Affiliate Payment Automation: Tracking to Disbursement

Now that the pain points have been discussed and the need for automation has been understood. It is important to understand what goes on behind the scenes when an automated affiliate payout runs from start to finish.

Commission Tracking and Scheduling

The process begins the moment performance data is recorded. The system integrates with affiliate tracking software or the CRM system to collect earned commissions or submitted invoices.

However, instead of getting it all manually reviewed, the system applies logic such as –

- Minimum payout thresholds

- Specific cycle dates

- Rules for holding payment (for fraud checks, during dispute periods, or when there is a new affiliate)

Validation and Approval

Before the funds are processed, the platform automatically verifies the details. It checks affiliate or vendor accounts, ensures sufficient balance, and enforces compliance. It checks whether –

- If KYC verifications are complete

- If the affiliate ID is matched correctly

- If the payment details are valid

If there are any sort of misses, be it a mismatch in the invoice, any unverified account, or an abnormal increase in traffic, the system automatically pauses the specific payout.

Payment Execution

Once approved, the system pushes the payouts through the selected methods –

- Bank transfers

- PayPal / digital wallets

- UPI

- Instant payouts

- Global payout rails

It must be noted how modern affiliate payment automation can process hundreds of payouts simultaneously with one click or even fully automatically at a scheduled time.

Notification and Tracking

Automation ensures every stakeholder gets transparency instead of uncertainty. Both you and your affiliates receive confirmations, and a dashboard logs each payment status.

You can track payments in real time; if a payment is awaiting processing, has been processed or is not processed, you will know immediately.

This also ensures that every detail is recorded.

Core Components of Payout Automation

Affiliate payment automation depends on the right software ecosystem. Many affiliate management platforms include built-in payment tools or integrate with specific payout services with the help of an API.

Some of the key features that they provide are as follows –

Affiliate Tracking and Accounting – Platforms like Trackier or Everflow can export the earned commissions directly to the payout engine. Similarly, integrating with accounting software like Zoho Books lets you match the incoming invoices automatically.

Payment Gateways and API – Integrations are made with platforms like PayPal and Razorpay so that you can send funds without manual bank uploads. Some systems even optimize costs by choosing the cheapest route (bank transfer or wallet, or card) per transaction.

Bulk and Scheduled Payments – Tools support bulk payouts in one go or allow scheduling future disbursements with approval workflows. This is ideal for repeated affiliate commissions or vendor payments.

Multi-Currency Support – Global affiliate programs demand foreign currency handling. And so, automation platforms handle currency conversions and local payout methods. Affiliates can therefore receive funds in their local currency, which further reduces additional fees and delays.

Reporting and visibility – Dashboards display payment status, totals, and history in real time. Finance teams can pull instant reports on who’s paid, pending, or failed, which simplifies the whole process.

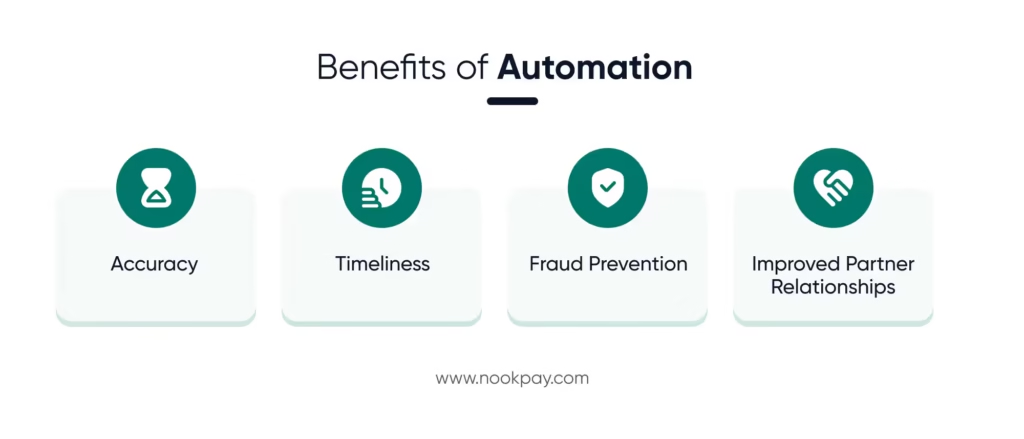

The Automation Advantage

According to Deloitte, incorporating this system in your business reduces costs by 60%.

Affiliate payment automation is not just about saving time and money; it is also about improving the quality, speed, and reliability of the entire workflow, which also impacts your finances.

Accuracy

Systems don’t forget, get tired, or have a bad day, which minimizes the scope of blunders. Accuracy here means –

- Automatically match conversion data with the correct affiliate.

- Prevent duplicate payouts by verifying entries.

- Ensure payment information is validated before sending

Timeliness

Instead of waiting until the end of every month to get paid, affiliates across geographies can receive payments at the same time without manual transfer initiation. This drastically reduces the processing time as thousands of interactions are easily processed within seconds.

With the help of features like real-time tracking and notifications, you can catch the issues and can resolve them quickly. This also ensures timely disbursements.

Fraud Prevention

As per the ‘Global Fraud Report’ by Visa Acceptance Solutions, merchants now experience more fraud attacks than they did in the past few years. This not only erodes the revenue but also affects customer relationships.

What payout automation does here is –

- It checks each transaction in accordance with the predefined rules, such as IP addresses, device fingerprints, and conversion speed.

- It tracks an affiliate’s past performance and flags sudden or unusual spikes in conversions or changes in traffic patterns that could potentially be fraudulent.

- It comprises features like anomaly detection, which flags unusual invoice amounts, duplicate submissions, or payments to suspicious accounts.

For example, if an affiliate reports five times of his conversions overnight, the system can flag it for review, while the payments will be processed for the other affiliates.

Improved Partner Relationships

As automation removes any sort of uncertainty and guesswork, it creates a sense of trust and transparency for affiliates. Their payment and invoice status are directly shown on the dashboard. This reduces questions like “Where is my payout?”

If an affiliate can see their payout confirmed in real time, they can reinvest earnings immediately. This also increases their chances of scaling traffic with your brand.

How Does This Affect the Affiliate Experience?

- Enhanced transparency, as affiliates always know the payment status.

- Faster payouts improve their own cash flow and the capability of reinvestment

- Fewer disputes because the data is accurate and visible.

Better partner motivation and experience eventually lead to higher-quality traffic as you attract high-performing affiliates.

By using platforms like NookPay that offer affiliate payment automation, you don’t have to spend your time focusing on organisation, as you can now actually focus on real growth.

This is because automated payouts are not just about convenience but the overall benefit of your business.

Final Thoughts

Affiliate payment automation is no longer just a nice-to-have. Infact it’s a competitive necessity. As affiliate programs grow in size and complexity, automation ensures accuracy, speed, compliance, and trust at scale. By removing manual friction and uncertainty, businesses can build stronger affiliate relationships while focusing on sustainable growth. That too, without payouts becoming a bottleneck.

Help Centre

How does affiliate payment automation simplify managing large-scale partner payouts?

Payment automation makes it easy to handle large-scale partner payouts as it brings together data, automatically calculates commissions, and carries out multiple payments without any manual work.

Additionally, it also cuts down on mistakes, accelerates approvals, and keeps security standards intact. It ensures that high-volume payout management becomes quicker and more precise, which further helps in scaling.

How does automated affiliate payout software reduce errors compared to manual spreadsheets?

Automation eliminates manual data entry, pulls real-time commission data from tracking platforms, validates performance, and generates accurate payouts. This reduces miscalculations, duplicate entries, delays, and reconciliation issues commonly seen when managing spreadsheets at scale.

Can affiliate payment automation handle global payments with different currencies and compliance rules?

Yes. Modern platforms support multi-currency payouts, region-specific tax requirements, and automated KYC/AML checks. This makes it easier to onboard international affiliates, pay them on time, and maintain compliance without managing multiple country-level systems manually.

What features should businesses look for when choosing an affiliate payment automation platform?

Some key features that a payment automation platform must have include automated commission tracking, multi-currency support, fraud checks, API integrations, mass payout options, compliance automation, and transparent dashboards for affiliates.