Imagine customers are landing on your website, selecting their products, and completing the payment process in a few seconds. Your team does not have to check or enter the details manually; all the transactions are recorded automatically in your database. no delays, no confusion, no extra work.

Behind this smooth automation, the digital payment platform plays an important role. It keeps the entire process quick, easy, and secure for both customers and businesses. In today’s time, people expect fast checkout, and businesses want a system that handles the end-to-end payment process without any errors.

In this article, you learn more about digital payment platforms, and what are the essential features of these platforms, and how they benefit modern businesses.

What is a Digital payment platform?

A digital payment platform is a technology system that allows businesses to accept, process, manage, and monitor online transactions using digital channels. This includes payments made through cards, UPI, mobile wallets, bank transfers, QR codes, and even crypto, depending on business needs.

Unlike traditional payment systems that rely on manual verification or slow settlement cycles, digital platforms automate the entire flow from checkout to payout. This means:

- Faster transactions

- Reduced errors

- Real-time tracking

- Automated reconciliation

- Secure data handling

Platforms like NookPay go beyond simple payment acceptance. They integrate analytics, invoicing, currency conversion, recurring billing, and payout management in one place, allowing businesses to scale without operational complexity.

Why are Digital Payment Platforms Rising?

Digital payment platforms are becoming more popular because the way people buy and sell has changed. These four major shifts explain why:

1. Customers expect quick and simple checkouts

No one wants to type long card numbers or wait through slow loading screens. Today’s customers want fast, one-tap payments, auto-filled details, and trusted gateways that complete the process in seconds. A smoother checkout means more completed purchases.

2. Businesses need faster settlements

For any business, cash flow is everything. Traditional payments can take days to settle, which slows down growth. Digital platforms speed up settlements and automate invoicing so companies get their money sooner and operate without delays.

3. Global commerce is expanding

Businesses now sell across countries, which means payments come in different currencies and through different banking systems. Digital payment platforms support multi-currency payments, global transactions, and compliance, making international sales easier and safer.

4. Security standards have become stricter

Online fraud is rising, so businesses must follow strict security rules like PCI-DSS, encryption, and strong fraud detection. Digital payment platforms already include these protections, reducing risk and making transactions safer for both customers and businesses.

Because of these shifts, digital payment platforms are no longer optional. They have become essential for any modern business that wants to grow, stay secure, and deliver a great customer experience.

What Makes a Payment Platform Truly Digital?

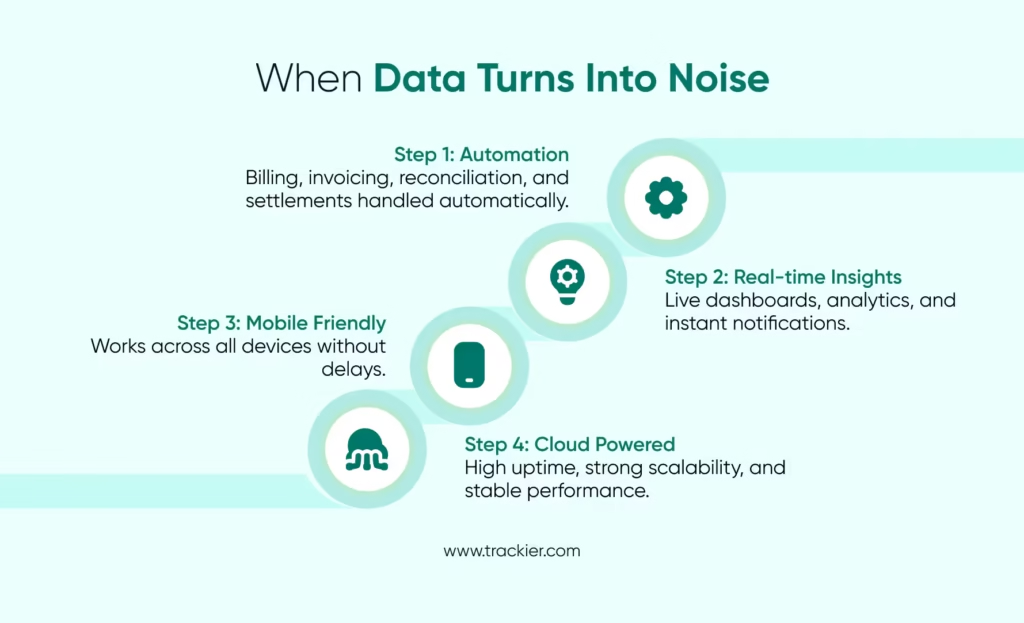

A payment system becomes truly digital when it removes manual work and connects every step of the payment journey into one smooth, automated flow. Instead of humans handling tasks one by one, the platform manages everything in real time. Here is what defines a real digital payment platform:

1. Automation from start to finish

A digital platform handles billing, invoicing, reconciliation, and settlements automatically. This means fewer errors, no manual updates, and faster processing. Businesses save hours of work because the system takes care of the entire cycle on its own.

2. Real-time visibility

Digital platforms give businesses instant access to what is happening. Live dashboards show payments as they come in, notifications alert you about important updates, and analytics help you understand customer behavior, revenue trends, and payment performance. This real-time clarity helps teams make smarter decisions.

3. Multi-device and mobile-friendly operations

A true digital payment platform works perfectly on phones, tablets, and computers. Customers can pay anytime from anywhere, and businesses can monitor transactions without being tied to a single device. This flexibility removes friction and improves the overall experience.

4. Cloud-based infrastructure

Digital platforms are built on the cloud, which gives them higher speed, more uptime, and the ability to scale easily during peak traffic. Even if there are thousands of transactions happening at once, the system remains stable and responsive.

Platforms like NookPay follow all these principles and provide a complete digital-first ecosystem where payments are faster, safer, and fully automated from end to end.

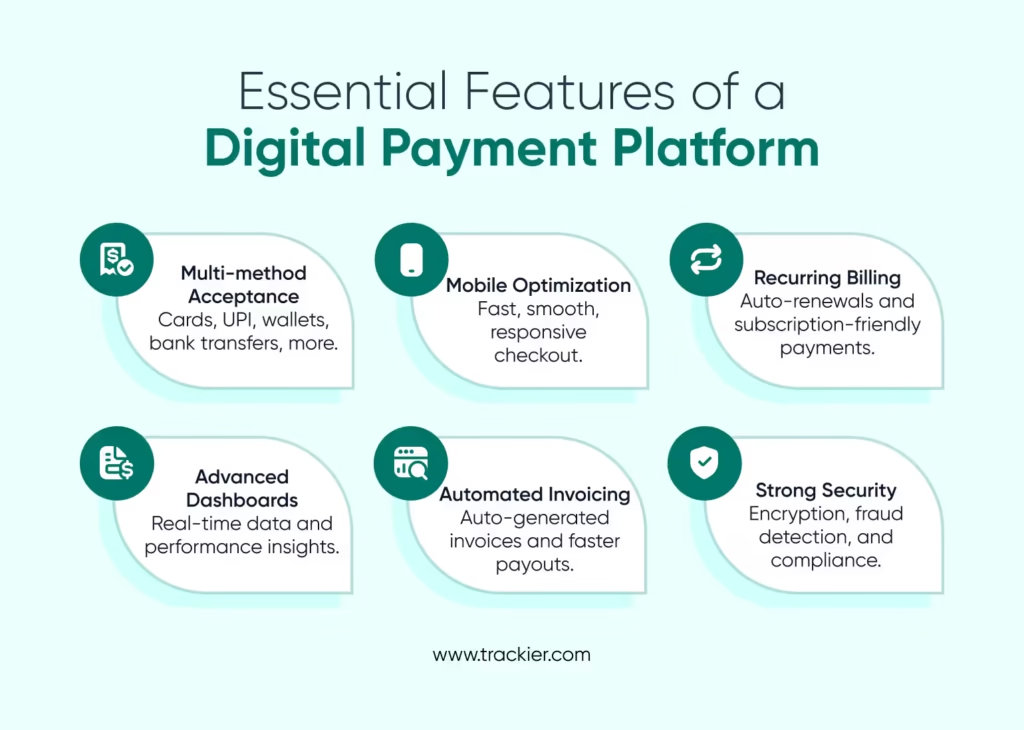

Key Features of a Digital Payment Platform

Here are the essential features every modern business should expect from a reliable system.

1. Multi-method Payment Acceptance

Customers use different payment methods depending on convenience, speed, and location. A strong digital payment platform must accept:

- Debit and credit cards

- Net banking

- UPI

- Mobile wallets

- Bank transfers

- QR payments

- International cards

- Alternative currencies (if needed)

For iGaming and fintech businesses, this flexibility is vital. With NookPay, operators can offer multiple payment routes to reduce drop-offs and boost conversion rates.

2. Mobile-Optimized Payment Experiences

More than 65 percent of all payments happen through mobile devices. That means any friction on mobile screens results in lost conversion.

A good digital payment platform ensures:

- Fast loading

- One-click or one-tap payment options

- Auto-filled payment fields

- Easy OTP or PIN steps

- Secure mobile encryption

- Responsive UI

3. Support for Recurring Billing

Subscription businesses are growing rapidly. For them, manual billing becomes impossible after a certain stage.

Digital payment platforms support:

- Auto-charging

- Renewal reminders

- Failed payment alerts

- Smart retries

- Flexible billing cycles

With NookPay’s recurring billing, membership apps, streaming services, and online tools can manage thousands of customers without losing track of payments.

4. Advanced Dashboards and Real-Time Analytics

Payment data reveals powerful insights. A platform like NookPay provides:

- Real-time transaction updates

- Revenue breakdown

- Refund and chargeback data

- Currency-wise performance

- Customer behavior insights

- Daily, weekly, and monthly reports

This helps businesses understand how users are paying, where they drop out, and which methods perform the best. For iGaming brands, these insights are essential for compliance, finance audits, and long-term growth.

5. Automated Invoicing and Payout Management

Manual invoicing leads to delays, errors, and miscalculations. Digital platforms automate:

- Invoice creation

- Tax calculation

- Currency conversion

- Scheduled payouts

- Status tracking

NookPay is built with automated invoicing so businesses can send flawless invoices and settle payments quickly without financial stress.

6. Built-in Fraud Prevention and High-Level Security

Security sits at the center of digital payments. A secure digital payment platform includes:

- PCI-DSS compliance

- Tokenization

- Data encryption

- 2FA and OTP verification

- Device-level fingerprinting

- AI-based fraud detection

- Chargeback management

7. Seamless Integration with Business Systems

A digital payment platform must connect smoothly with CRMs, finance tools, affiliate systems, and business dashboards.

Modern platforms offer:

- API integrations

- Webhooks

- Plug-and-play modules

- SDKs for websites and apps

How Digital Payment Platforms Improve Customer Experience

The customer experience during payment is often the deciding factor in whether a user completes or drops the transaction. Here is how platforms like NookPay improve the journey.

Final Thoughts

The rise of the digital payment platform is transforming how modern businesses operate. With features like multi-method acceptance, recurring billing, mobile optimization, analytics, and automated invoicing, these platforms are not just tools. They are growth engines.

For businesses that want to stay ahead, improve customer experience, reduce manual work, and scale smoothly, choosing the right digital payment solution is essential.

NookPay brings everything today’s brands need in one seamless system, making payments simpler, faster, and smarter.

Help Centre

1. What are Digital Payment Platforms?

Digital Payment Platforms are technology-driven systems that allow businesses to accept, process, manage, and track online payments through digital channels like cards, UPI, wallets, bank transfers, and QR codes. They automate the entire payment flow, from checkout to settlement, while ensuring speed, accuracy, and security.

2. Why are Digital Payment Platforms important for modern businesses?

Digital Payment Platforms help modern businesses reduce manual work, speed up transactions, improve cash flow, and deliver a seamless checkout experience. They also support real-time tracking, automated reconciliation, and advanced security, which are essential for scaling operations in today’s digital-first economy.

3. What features should businesses look for in Digital Payment Platforms?

Businesses should look for features such as multi-method payment acceptance, mobile-optimized checkout, recurring billing, real-time analytics, automated invoicing, fraud prevention, and easy API integration. Platforms like NookPay combine all these features into a single, unified system.

4. Are Digital Payment Platforms secure for online transactions?

Yes, reliable Digital Payment Platforms follow strict security standards such as PCI-DSS compliance, encryption, tokenization, OTP verification, and AI-based fraud detection. These measures protect sensitive data and reduce the risk of fraud and chargebacks.